A Generation’s Family Wealth at Stake

Collectively, Gen X and Gen Y generations along with the Baby Boomers lost trillions of dollars in net worth over the last seven years as a result of the housing collapse. Homeowners’ net worth is back to being 30 times greater than that of renters as the housing market recovers and home values increase. However, average family net worth is still not at the level it was prior to the crisis.

Collectively, Gen X and Gen Y generations along with the Baby Boomers lost trillions of dollars in net worth over the last seven years as a result of the housing collapse. Homeowners’ net worth is back to being 30 times greater than that of renters as the housing market recovers and home values increase. However, average family net worth is still not at the level it was prior to the crisis.

We must make sure that future generations are better informed regarding housing in order not to repeat what happened.

The Millennial generation has a decision to make as the economy improves and they begin to move out of their parents’ home and move into living space of their own. Should they rent or should they own? Before they make that decision, they should know enough to make an informed decision.

RENTING

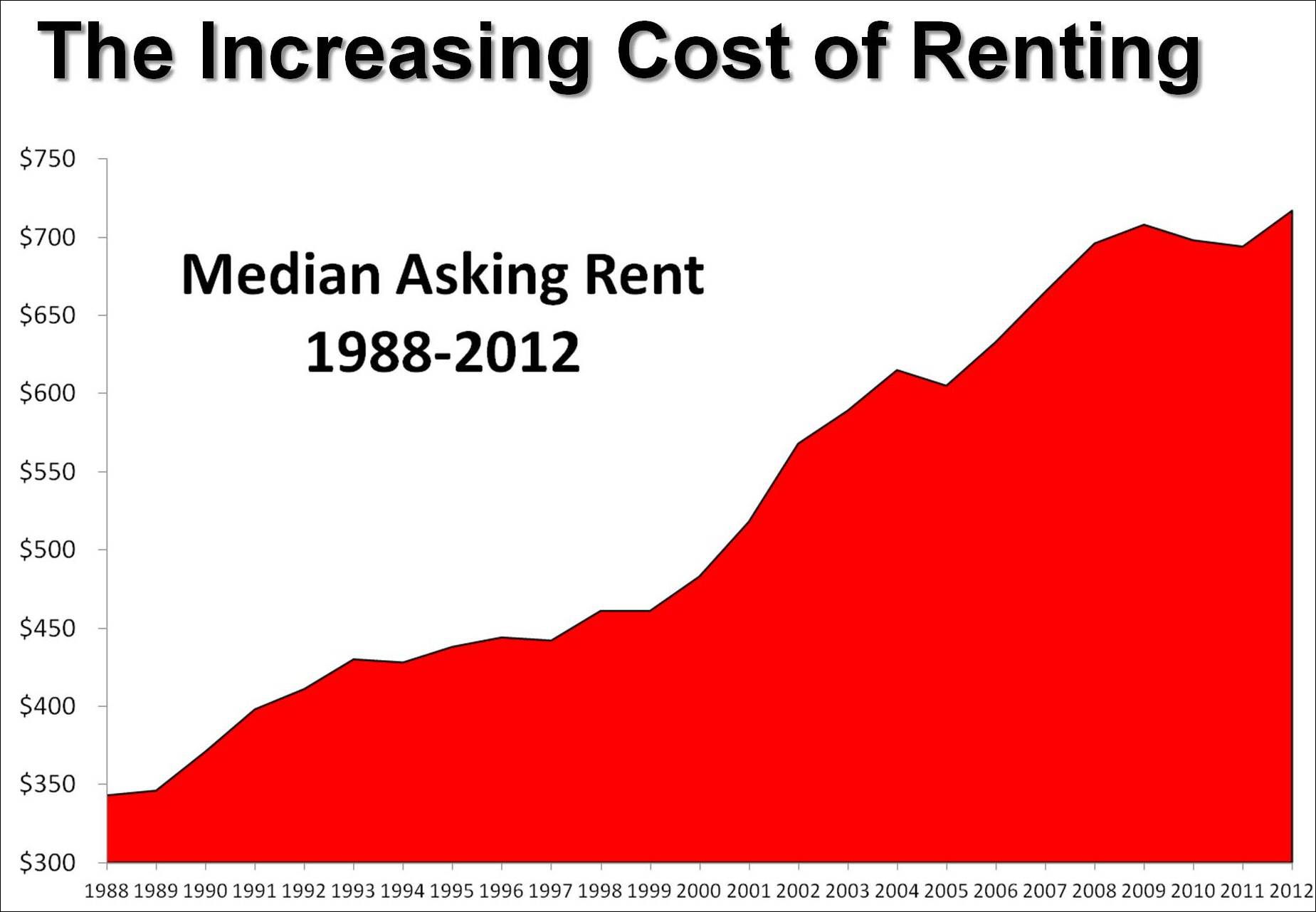

Some think that renting will be less expensive than purchasing. They should realize that Shaun Donovan, Secretary of the Housing & Urban Development Agency, recently said:

"We are in the midst of the worst rental affordability crisis that this country has known."

At the same time, Christopher Herbert, Research Director at the Joint Center for Housing Studies at Harvard University, revealed that cost of renting is about to increase significantly:

“Well, I think it’s a basic question of supply and demand. When you have that many more renters coming into the market looking for housing, and the supply of housing isn’t responding as quickly as it might, that’s going to push rents up, even if incomes are low.”

OWNING

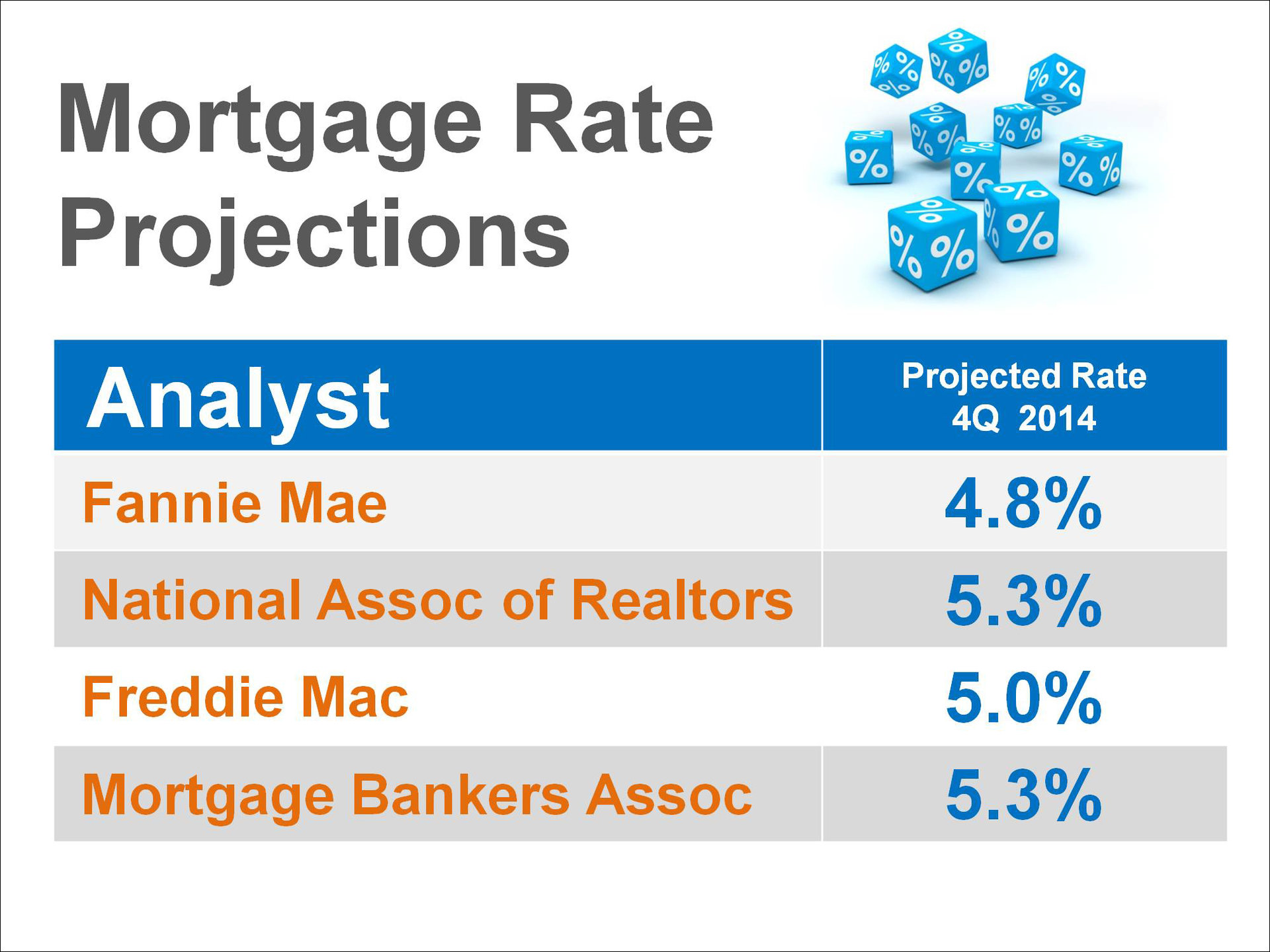

Not every young adult is prepared to own their own home. However, those that are should realize home prices and mortgage interest rates will probably both continue to rise as we move through 2014.

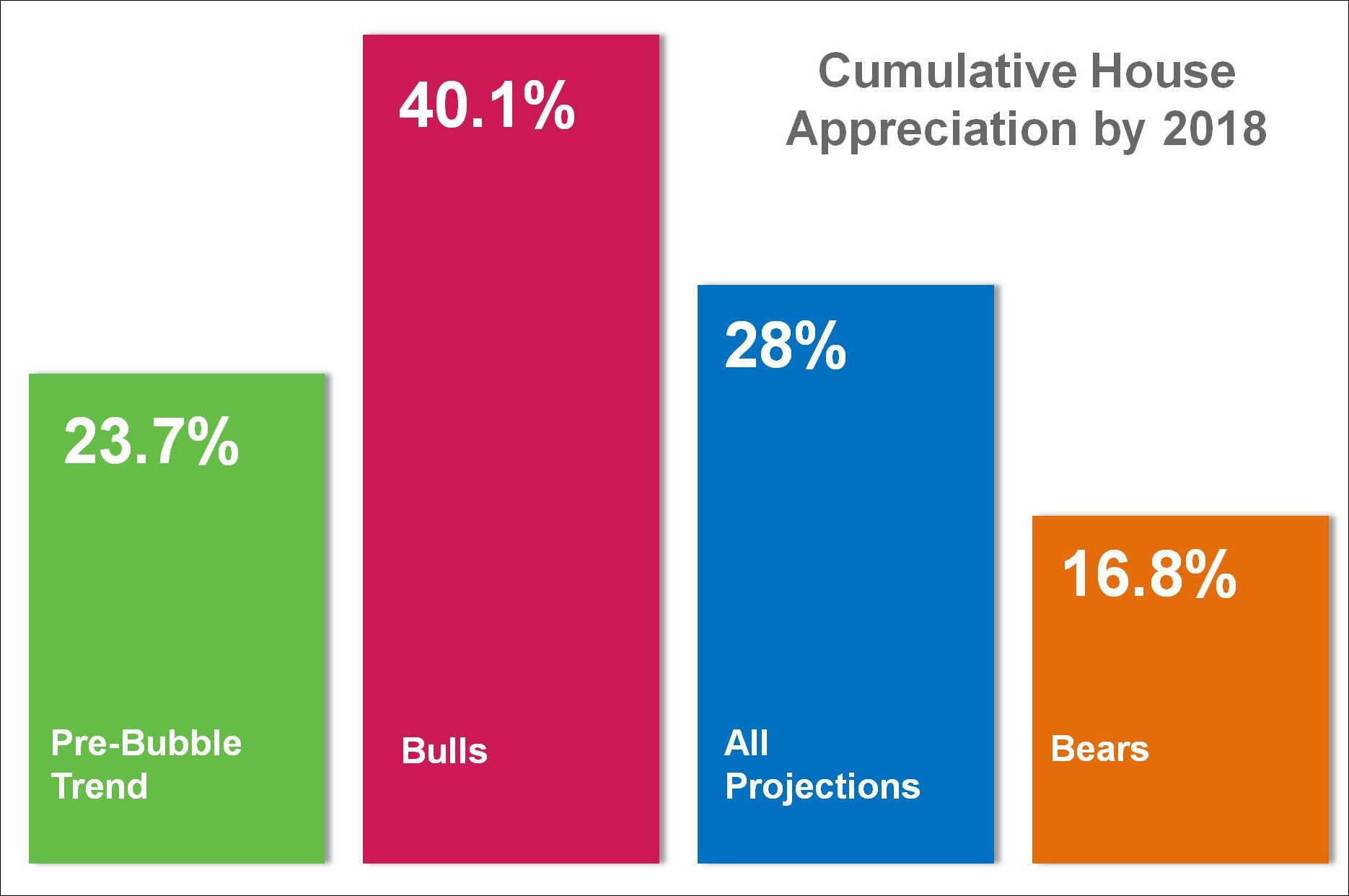

The opinion of the 100+ experts who participate in the Home Price Expectation Survey is that home values will increase by approximately 4% over the next twelve months and by over 25% over the next five years. The entities that project future mortgage rates see them increasing by almost a full percentage point by the end of the year.

This means that the median priced home in the country will ‘cost’ a buyer almost $200 more a month by this time next year. That will be an additional $2,000 paid annually by the purchaser; about $60,000 over the life of a 30 year mortgage.

Bottom Line

Several generations were the victim of falling prices over the last seven years. Let’s make sure that Millennials are not the victim of rising prices over the next seven years because they unnecessarily delayed their purchasing decision. Call us today to get your new home www.247realtyservice.com